Could the Net Lease Industrial Market Have Back-to-Back Record Setting Years?

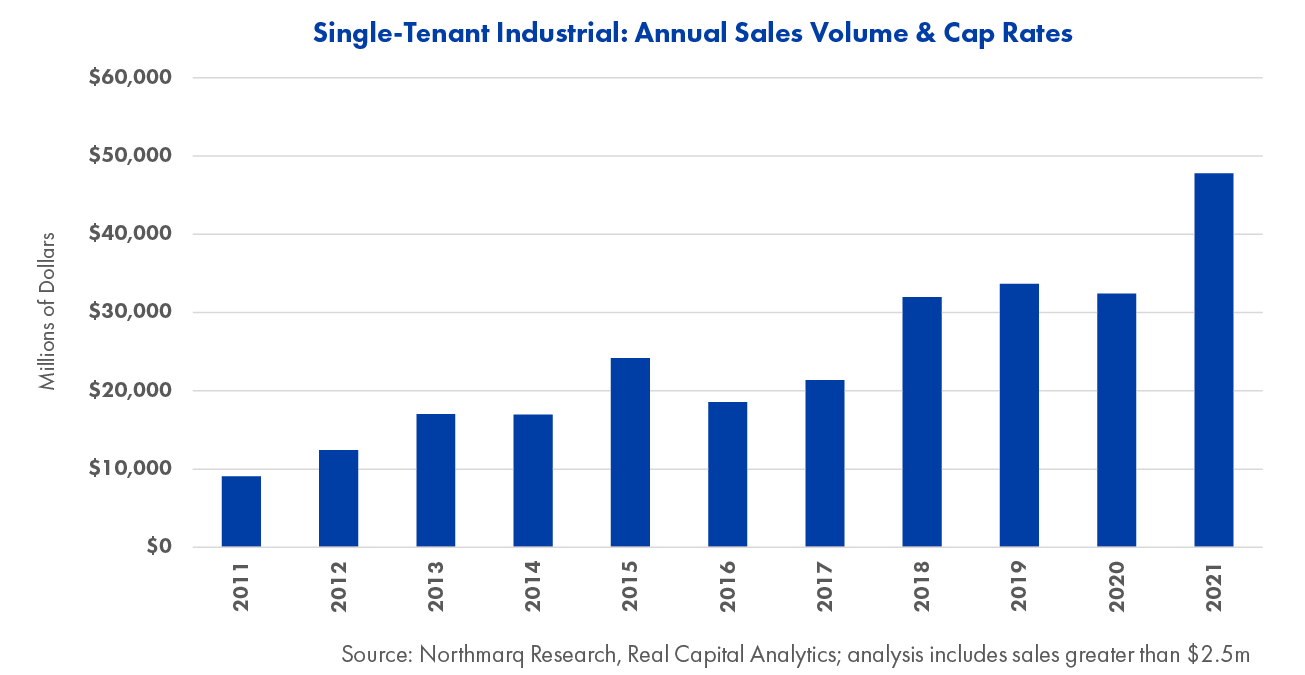

The single-tenant net lease industrial sector reported staggering levels of investment sales volume in 2021, exceeding $47.8 billion and setting a new annual record by an impressive margin. The previous three years had seen very consistent levels of activity, ranging from $31.9 billion to $33.7 billion, and while we predicted 2021 would be a record-setting year, we didn’t expect the market to shatter the annual record by 42 percent. The current level of demand for industrial assets is the highest it has ever been, but are these levels sustainable? Here, we explore the likelihood of seeing a repeat performance in 2022 and outline what some of the most influential factors will be across the industrial sector.

The single-tenant net lease industrial sector reported staggering levels of investment sales volume in 2021, exceeding $47.8 billion and setting a new annual record by an impressive margin. The previous three years had seen very consistent levels of activity, ranging from $31.9 billion to $33.7 billion, and while we predicted 2021 would be a record-setting year, we didn’t expect the market to shatter the annual record by 42 percent. The current level of demand for industrial assets is the highest it has ever been, but are these levels sustainable? Here, we explore the likelihood of seeing a repeat performance in 2022 and outline what some of the most influential factors will be across the industrial sector.

"While we predicted 2021 would be a record-setting year, we didn’t expect the market to shatter the annual record by 42 percent."

Last-Mile Logistics | Supply chain issues continue to persist, and this is driving retailers to be as efficient as possible with their distribution and delivery. Part of this strategy is ensuring they have well-located last-mile facilities to service not only large metro areas, but secondary and tertiary markets, suburban areas and rural markets as well. Online shopping has become commonplace for consumers, and there’s a growing expectation for next-day and same-day delivery. An explosion of growth in recent years, especially from Amazon, has helped drive investment sales volume, as investors clamor to acquire state-of-the-art, newly built facilities leased to exceptionally strong credit tenants. But how will the market be impacted knowing that Amazon plans to slow their industrial growth? It’s possible other retailers like Walmart, grocery store operators, drugstores or even dollar stores could elect to ramp up industrial expansion to reach a wider swath of consumers. Similarly, these and other companies might become more aggressive in the acquisition of future development sites for warehouse, distribution and last-mile facilities once Amazon becomes a less frequent competitor for those prime locations. If these or similar scenarios don’t occur, however, it’s likely the industrial market will see a drop in sales activity year-over-year, as newly built Amazon-leased facilities were a significant contributor to investment sales volume during 2021.

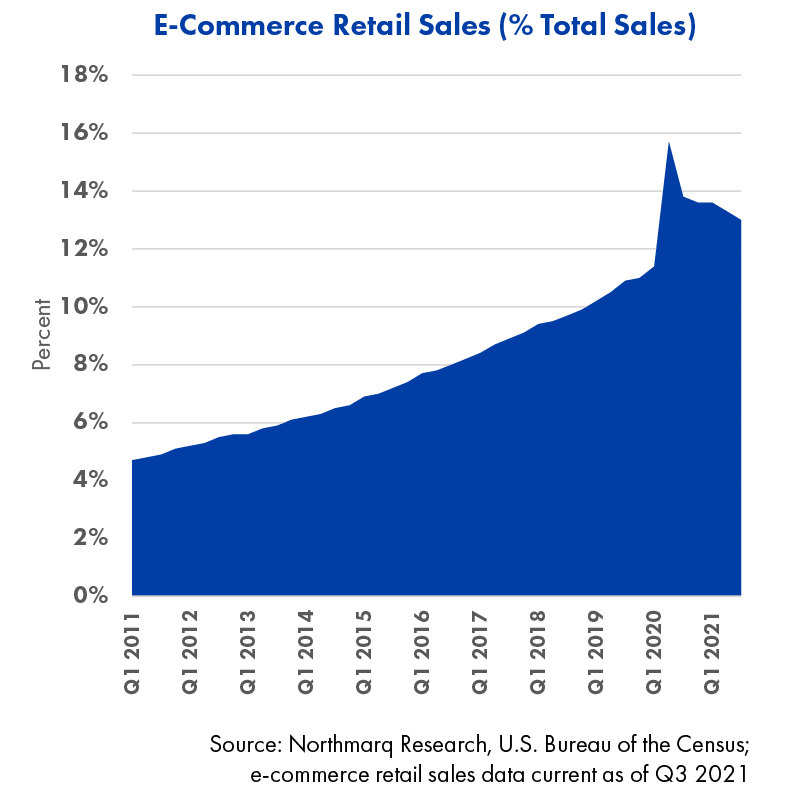

Retail's Influential Role |  The industrial market is heavily influenced by retailers. As supply chain issues impact online orders and life resumes a more normal pace post-pandemic, consumers are returning to stores and relying less on online shopping. This is welcomed news for the brick-and-mortar retail sector, but will this shifting dynamic substantially impact demand for industrial assets in 2022 and beyond? We saw a 430-basis-point spike in e-commerce retail sales as a percentage of overall retail sales during the height of the pandemic, reaching a high of 15.7 percent. Although that statistic has been trending downward in the quarters since, e-commerce will continue to play a vital role. In fact, some projections estimate e-commerce retail sales to reach nearly 20 percent by 2025. If estimates are accurate, the market will need to see increased levels of new industrial construction to sustain consumer demand. This will help to drive real estate investment activity in future years, although short-term sales volume might not be influenced as greatly.

The industrial market is heavily influenced by retailers. As supply chain issues impact online orders and life resumes a more normal pace post-pandemic, consumers are returning to stores and relying less on online shopping. This is welcomed news for the brick-and-mortar retail sector, but will this shifting dynamic substantially impact demand for industrial assets in 2022 and beyond? We saw a 430-basis-point spike in e-commerce retail sales as a percentage of overall retail sales during the height of the pandemic, reaching a high of 15.7 percent. Although that statistic has been trending downward in the quarters since, e-commerce will continue to play a vital role. In fact, some projections estimate e-commerce retail sales to reach nearly 20 percent by 2025. If estimates are accurate, the market will need to see increased levels of new industrial construction to sustain consumer demand. This will help to drive real estate investment activity in future years, although short-term sales volume might not be influenced as greatly.

Portfolio Sales | While individual sales certainly add up, there’s no denying that a few high-profile portfolio transactions can significantly influence sales volume totals. In the past year, portfolio sales accounted for more than one-third of all activity, and in fourth quarter 2021 alone, represented nearly half of the investment totals. While many portfolio sales occurred under the $25 million mark and only included a handful of properties, there were quite a few noteworthy transactions in the several hundred-million-dollar range with multiple assets included. Walmart and Amazon distribution facilities, FedEx leased properties, retailer warehouses including Staples, PetSmart and Big Lots, and distribution hubs for Williams Sonoma and Kraft Foods are just a few of the well-recognized names represented in 2021’s portfolio sales. REIT and institutional investor activity is particularly strong for portfolio sales. Combined, these investor profiles represented more than 53 percent of sellers of single-tenant industrial portfolio transactions last year. This figure was up substantially from 2020, where these combined groups accounted for less than 40 percent of portfolio sellers. Buyer demand for quality assets continues to be incredibly strong, so in order for 2022 to see another year of strong portfolio sales, current owners in the REIT and institutional investor groups must bring their offerings to market.

"To surpass the newly set record, the market would need to report an average of $12 billion of investment sales each quarter."

Despite being just 45 days into first quarter 2022, strong momentum appears to have carried over to the new year. Investors remain hungry and industrial continues to be the darling of the net lease market. While there’s no expectation we will see back-to-back record setting quarters – an $18.3 billion fourth quarter 2021 seems nearly impossible to repeat – there is a possibility that annual totals for 2022 could match last year’s strength. To surpass the newly set record, the market would need to report an average of $12 billion of investment sales each quarter. The proverbial stars would need to align, and there’s much that could happen in the next 10 months to impact the sector’s performance, but a $12 billion quarter isn’t unthinkable. The market has successfully reached that threshold five times since late 2018. What remains unclear is if market dynamics could realistically support four consecutive quarters of such strong activity and result in yet another record-setting year for the net lease industrial sector.

Insights

Research to help you make knowledgeable investment decisions