Top Trends and Outlook for Net Lease Retail

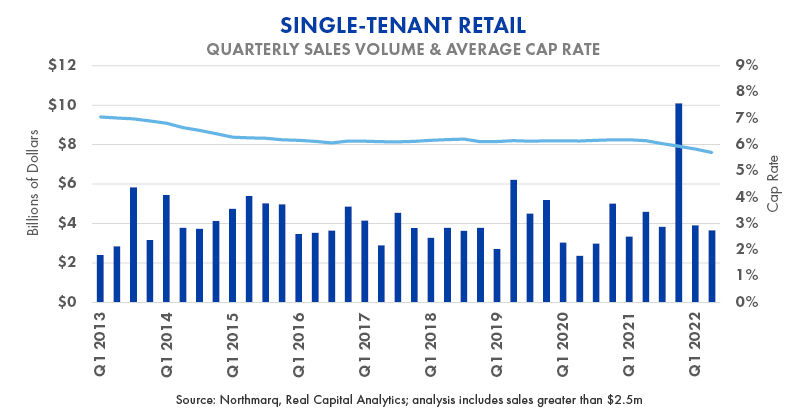

In recent years, the single-tenant net lease retail sector has taken its fair share of hits. In 2020, we witnessed investment sales volume drop to its lowest level since 2012 as many investors pressed pause to wait out the worst of the pandemic. By year-end 2021, however, investment activity came roaring back, posting a new quarterly record during fourth quarter of more than $10.1 billion and illustrating that retail remained a very desirable asset class for net lease investors. In the first two quarters of 2022, we’ve seen the entire single-tenant net lease market return to more normal sales volume levels, with approximately $7.6 billion posted for the opening half. This trails last year’s opening half by only 4.6 percent, and preliminary figures for third quarter 2022 suggest we’ll be on par year-over-year.

For more insight into the current market, we caught up with BJ Feller, Managing Director & Partner in Chicago, Illinois. Here, we discuss what’s impacting single-tenant net lease investment activity and demand today, and what we might expect to see in the coming year.

Lanie Beck: What are the top trends impacting the net lease retail sector today?

BJ Feller: The first, most important factor that is impacting investment is absolutely the cost of financing new assets. Interest rates are approximately 150 to 200 basis points higher than they were at the beginning of the year, and investors are assessing what that means for acquisitions and leverage returns. The second biggest factor that we are seeing impact investment activity continues to be perspectives about the shifting landscape between online and physical retail. Although this has been a trend that investors have been watching closely for quite some time, it continues to play an impact. The final item is simply the supply-demand imbalance, with not enough long-term high-credit investment assets available to meet buyer demand.

LB: Can you tell me more about the supply-demand imbalance?

BF: In spite of higher interest rates, there is still not nearly enough supply in the most popular sectors of the net lease marketplace to meet investor demand. On one end of the spectrum, there are too few long-term credit properties to fully satisfy the needs of institutional and private investors. On the other end, for shorter lease term properties or weaker credit assets, there’s perhaps some degree of an oversupply of assets currently.

LB: As you’ve watched interest rates rise, how has the net lease retail sector reacted?

BF: Overall, transaction velocity has not slowed nearly as much as we might have expected given the quick and steep rise in interest rates. The supply-demand imbalance that has existed for the last few years means that there’s still a strong overall demand for buyers to make acquisitions, but we are seeing a lot more cautiousness from investors.

LB: Are you beginning to see pricing changes across the net lease retail sector?

BF: So far, we have seen the most upward pressure on cap rates and downward pressure on purchase price for larger transaction sizes. More specifically, assets greater than $20 million in purchase price have seen cap rates rise, generally speaking, somewhere between 50 to 100 basis points. Smaller price point assets have been more immune to the broad increases but are still experiencing some degree of upward pressure on cap rates. In the coming quarters, I expect we’ll see cap rates for most net lease retail subsectors continue on an upward trend – some slightly, and some more dramatically – in response to significantly higher interest rates.

LB: Looking ahead to 2023 and beyond, where do you see the most opportunities for investors?

BF: Regardless of broad marketplace conditions, there are always fairly compelling investment opportunities. We believe that continuing to sort through all of the opportunities and staying on the cutting edge of shifting marketplace dynamics makes sense. Particularly right now, we believe net lease cannabis assets represent a very interesting risk-adjusted return opportunity. Additionally, essential retail concepts remain high priority targets for investors. Quick service restaurants, drugstores, grocers, medtail and others are still trading at high volumes and can be comfortable assets for investors to own during times of market uncertainty. We’re also seeing an uptick in interest for experiential retail and fitness centers, now that pandemic conditions are largely in the past.

To download a copy of this report, please provide the following information:

Read More

Insights

Research to help you make knowledgeable investment decisions