Know your lockbox options—and drawbacks—before you sign

It’s become common that loans originated for the CMBS market contain some form of in-place or springing lockbox mechanism to collect property rents. The requirement for cash management/lockboxes is being driven by a combination of rating agencies, CMBS bond investors and servicers, all of whom enjoy the added security it provides. As lockboxes have become more common, it’s important to understand the different forms of lockboxes, the associated costs and the issues they can create for commercial and multifamily real estate owners and operators. A national bank provides the majority of lockbox/cash management services, so we’ve included their estimated pricing in our descriptions. However, please note that lockbox costs are highly dependent number of payments that are received/sent, the form those payments take (cash, check, wires, etc.), if a restricted account and a cash management account are needed, and features the Borrower requires for the account. All of the options below require that setup fees be paid to the lockbox bank by the Borrower. Currently, approximately $1,000 is being charged for initial account setup costs. There are three main types of lockboxes: Soft, Hard and Springing. Learn more about each option below.

Soft Lockbox: The Borrower has some control over the property cash flow.

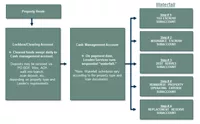

How it works: Soft lockboxes primarily work one of two ways: (A) All rents from the property are deposited or paid directly into a Lender-controlled account (aka lockbox/restricted account) and are subsequently swept to the borrower; or (B) Rents are deposited in the restricted account and then are swept to a separate cash management account and remain until an amount equal to the debt service payment is secured. Once that occurs the excess funds are swept to the borrower and the debt service payment is wired to the Lender on the payment date. Costs: Monthly account costs run from $300-$700+ for option A and $500-$1,000+ for option B. Costs fluctuate based on several factors including (but not limited to) the number of tenants, how payments are received and the frequency of outgoing payment/sweeps from the account. You should also know: The Borrower typically must maintain $5,000 in the restricted account. This is known as a “peg balance.”

Hard Lockbox: The Borrower does not have control of cash flow.

How it works: All rents flow through the Lender-controlled account and are subsequently swept to the Cash Management account. Tenant(s) are instructed to make rental payments directly to the Lender-controlled account, or in the case of apartments, the loan documents may allow rents to be deposited in the controlled account upon receipt by the property manager. On the payment date, funds from the Cash Management account are wired to the Lender to make the debt service payment and reimburse the Borrower for monthly operating expenses. Any excess cash flow from the property is commonly trapped in a cash-collateral, TI/LC or replacement reserve escrow. In the end, the defining feature between a hard and soft lockbox is that in a hard lockbox situation the Borrower is blocked from receiving any cash flow from the property outside of being reimbursed for operating expenses. Costs: Account costs run from $550-$1,000+ on a monthly basis. Costs fluctuate based on several factors including (but not limited to) the number of tenants, how payments are received and the frequency of outgoing payment/sweeps from the account. You should also know: The Borrower typically must maintain $5,000 in the restricted account otherwise known as a “peg balance.”

Springing Lockbox: The Borrower, Lender and lockbox bank execute Deposit Account Control/lockbox agreements at closing.

How it works: A Lender-controlled account is not opened, but the framework is put in place for an account to be established quickly if a trigger event occurs. The trigger events are most commonly tied to debt-service ratios, debt-yield, large lease expirations or a default. Costs: There are no ongoing costs unless the accounts are opened upon a trigger event.

Timing Is Everything

One issue worth noting is that both Hard and Soft lockboxes can create cash flow issues due to the timing of rental receipts and the mortgage payment due date. It can take the lockbox bank one to three days after receipt of rental payments to make the funds available. Additionally, the wire from the lockbox bank to the Lender/Servicer must be set up one day in advance, which effectively eliminates a day from the timeline. Essentially, this means that if a loan has a payment date of the fifth day of the month, rental payments likely need to be received by the first or the second day of the month in order to be used for that month’s payment. We somewhat commonly experience money getting “trapped” in these accounts until the following month because the funds did not clear in time. To compound that issue, some Lenders have language stating that if the payment date does not fall on a business day, the payment is due on the preceding business day. Timing issues can be mitigated to some extent if the payment date falls later in the month or if the loan documents allow a longer grace period. With that said, it is important to understand the timing of rental revenue for your property so that accommodating terms can be negotiated in the loan documents. In closing, I recommend that Borrowers closely examine the Cash Management provisions of loan documents and work with their NorthMarq Producers and advisors to ensure the terms align with how the property operates. Once the loan closes, its likely too late to make any changes.