December Economic Commentary: Stretched consumers, manufacturing contraction, and labor market challenges indicate slower economic growth

Chief Economist

Pohlad Companies

After the recent round of monthly reports, the only significant part of the economy that is showing any strength is the labor market – and we are seeing a gradual softening there as well. The Fed has started to hint at the possibility of slower interest rate increases at their upcoming meetings, but the ultimate peak level of interest rates and how long the Fed will hold rates at that level to achieve their inflation goals is still an open question.

Consumer Metrics

The Consumer Price Index (CPI) for October increased 0.4% month over month for the second month in a row resulting in the year-over-year figure declining to 7.7% from 8.2% in September. The core CPI (excluding food and energy) was up 0.3% month over month, and +6.3% year over year, down from the previous reading of +6.6%. Evidence of easing price pressures could be found throughout the report. With supply shortages normalizing, core goods prices declined 0.4% month over month. Removing the impacts of energy (+1.8%), food (+0.6%), and shelter (+0.8%), the remaining components declined 0.1%. The next CPI report on December 13 will be closely watched as it will be released the day before the Fed’s next announcement regarding the Fed Funds rate.

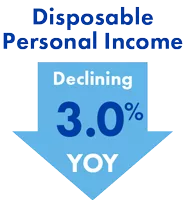

The elevated inflation pressures of the past year have left the consumer stretched. Real (inflation adjusted) disposable personal income is declining 3.0% year over year at the same time that real personal consumption expenditures are growing 1.8% year over year. To fill the gap between income and spending, consumers are dipping into savings, causing the savings rate to decline from 7.5% at the end of 2021 to 2.3% today – the second-lowest savings rate during the past 60 years. Additionally, consumer credit is up a record $346 billion year over year.

The Fed’s Senior Loan Officer survey for October reported stronger demand for credit card loans but also tighter lending standards and less willingness to extend consumer-installment loans.

Leading Economic Indicators and Manufacturing

The Leading Economic Indicators (LEI) index continues to decline and is now at the lowest level since May 2021. Year-over-year LEI is -2.7%, a reading that historically has foreshadowed an upcoming recession.

The ISM Manufacturing index is now indicating contraction in the manufacturing sector for the first time since May 2020. Output has weakened as a result of three consecutive months of shrinking orders. Additionally, the ISM survey indicated reductions in order backlogs, better supply chain performance, lower prices, and better inventory levels.

Employment and Labor Markets

The November Employment report showed payrolls increasing by a better-than-expected 263,000. The Household survey, on the other hand, reported a decline of 138,000 jobs following a 328,000 decline in jobs in October. The unemployment rate remained at 3.7% as the labor force contracted by 186,000. Most concerning to the markets and the Fed was the fact that average hourly earnings rose 0.6% month over month and +5.1% year over year. Labor shortages continue to pressure earnings growth. The participation rate has been trending lower recently and is now at 62.1% from 62.4% in August. Fed chair Powell recently emphasized the importance that wage growth will have in determining the path of inflation.

The Fed is looking for an easing in the demand for labor. The labor market is still a long way from a level consistent with non-accelerating inflation and is adjusting very slowly. Employers have been slow to reduce the headcount of their employees. Instead, hours are being reduced. The average workweek is now down to 34.4 hours after starting the year at 34.8. Declining hours of work results in lower levels of GDP, which is expected to slow from 2.9% in 3Q22 to 0.5% in 4Q22. GDP is expected to be 1.8% for the entire year, compared with 5.9% in 2021. Consensus is looking for 2023 GDP to be 0.4%.

Fed Expectations

The next meeting of the Federal Open Market Committee (FOMC) is December 13-14. Markets are expecting the Fed to announce a 50-basis-point (bp) increase in the Fed Funds rate, which would bring the upper Fed Funds target to 4.50%. A couple of 25-bp increases in early 2023 are also priced in with expectations for the Fed to go on hold in May/June.

The Fed has confirmed that they are not going to pause their tightening any time soon, and banks are also tightening their lending standards for almost all categories of loans. The availability of credit is declining, and its price is increasing. The Fed is tightening monetary policy in an economy that is already weakening. All of this points to slower economic growth and a high likelihood of recession 2023. At this time, the severity of any recession is unknown since that will depend on the timing and extent of Fed actions.

Insights

Research to help you make knowledgeable investment decisions