Orange County Q1 Multifamily Market Report: Investment Activity Spikes to Start 2021

Highlights:

- After some mixed performance in 2020, the Orange County multifamily market began this year on an upswing. Deliveries of new units were modest, vacancies ticked lower, and rents rose. Additional improvement is forecast for the remainder of the year as the local economy completely reopens.

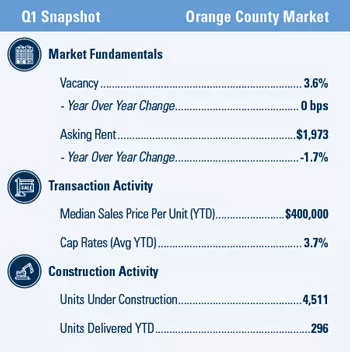

- Apartment vacancy dipped 10 basis points in the first quarter, reaching 3.6 percent. The rate has been very steady in recent periods and is identical to the figure from one year ago. Some additional tightening is forecast for the remainder of 2021.

- After some contraction in the second half of 2020, rents crept higher during the first quarter. Asking rents rose 1 percent to start the year, reaching $1,973 per month in the first quarter. Year over year, asking rents are down 1.7 percent.

- The local investment market started 2021 on strong footing, with several large properties changing hands. The median price spiked to $400,000 per unit in deals that closed during the first quarter, while cap rates averaged 3.7 percent.