Net Lease Drugstores: Retail Pharmacies Provide Hidden Insights on Broader Industry Trends

The current commercial real estate (CRE) environment represents a cloudy landscape with a large amount of uncertainty to navigate. Inflationary pressure, high interest rates and broader macroeconomic challenges loom overhead, causing many active investors to take pause while they wait for a clear indication of where the market is heading. However, some investors are looking ahead. By closely tracking segments of the market that have historically been indicative of broader trends, savvy investors can strategize now to better position themselves for the future – and one especially important segment that should be studied is the net lease drugstore sector.

Drugstores are a strong indicator of the broader market for several reasons. First, net lease pharmacies are similarly structured and have common lease terms, essentially making them a commodity in CRE. Secondly, these assets trade frequently across virtually all 50 U.S. states. Additionally, net lease drugstore investment sales are closely tracked with a large and dependable stream of data.

Furthermore, net lease pharmacy assets have two unique attributes that are especially relevant in today’s market. They typically have flat or low-growth rent schedules, and they have a large average deal size ($6.35 million in 2022), which usually requires debt financing. These two attributes make them especially susceptible to current inflationary pressure, as well as rising interest rates, making the net lease drugstore asset class one of the strongest indicators of how CRE is reacting to today’s macroeconomic challenges.

Looking back at the last five years of Walgreens and CVS Pharmacy sales comps, it is possible to glean insights and perspectives that shed light on the broader CRE marketplace. This data comes from Northmarq’s internal proprietary database, which is among the most comprehensive and reliable sources of net lease pharmacy data available. By analyzing trends for average cap rates, new listings and sales volume, we are able to understand how supply, demand and pricing are shifting for this segment. Drilling even more deeply, it becomes apparent how various sub-segments of the property class are shifting in more pronounced fashions.

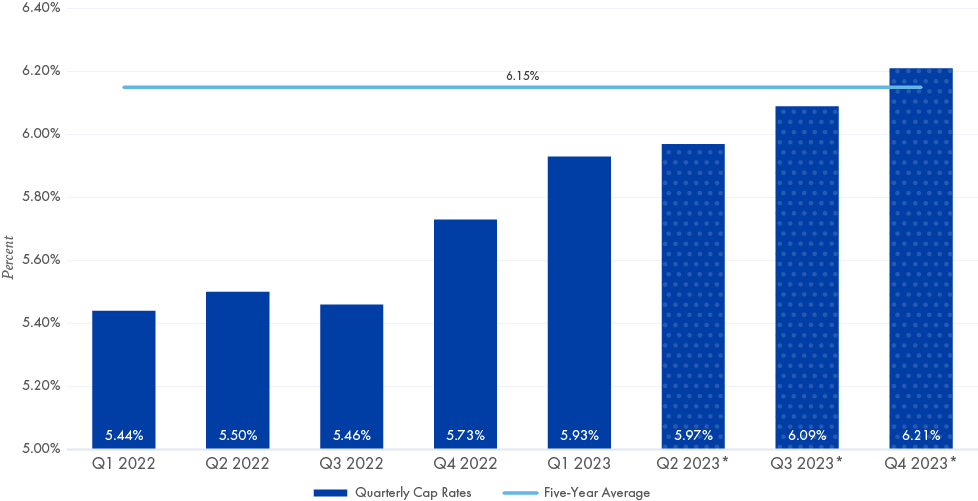

Cap Rates & Pricing

Driven by stubbornly high inflation, and a Fed eager to tame it with higher interest rates, cap rates for net lease drugstores – as with the broader CRE market – have been trending upwards for the past nine months. Average cap rates rose from 5.44 percent in first quarter 2022 to 5.93 percent in first quarter 2023, representing a 48-basis-point increase. However, this is still 22 basis points lower than the trailing five-year average of 6.15 percent. The current trends indicate that cap rates will likely surpass the five-year average during third quarter 2023 and could start returning to pre-COVID levels (6.42 percent) by next year.

Average Cap Rates for Net Lease Drugstores

These cap rate increases are being seen across all net lease drugstores but have been more pronounced in assets outside of primary markets and for deals with less than five years of lease term remaining. As of first quarter 2023, assets in secondary markets have seen a 68-basis-point increase from 2022’s average, rising from 5.48 percent to 6.17 percent, while those located in primary markets only saw a 32-basis-point increase, rising from 5.28 percent to 5.60 percent. Similarly, average cap rates for short-term assets, or those with less than five years of lease term remaining, rose 80 basis points during the same period compared to only a 25-basis-point increase for long-term assets, or those with 10 to 15 years of term remaining.

These trends indicate that there is still demand for quality assets and much of the cap rate increases we’re seeing are being inflated by inferior assets. Regionally, cap rates increased the most in the Midwest, West and Northeast, while average cap rates in the Southeastern states actually decreased between first quarter 2022 and first quarter 2023.

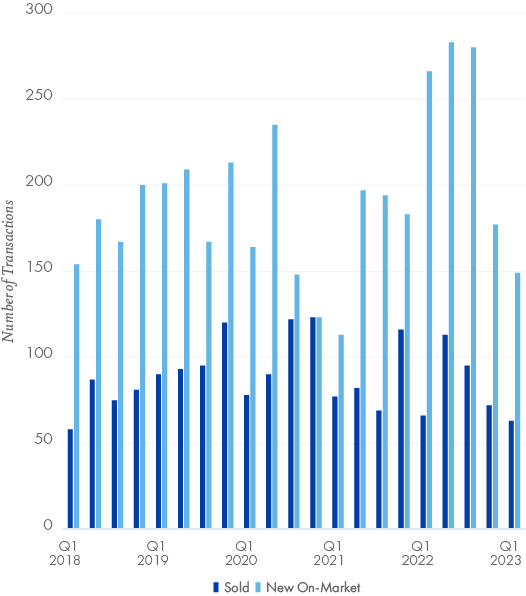

Supply & Demand

Beginning in second quarter 2021 and continuing throughout 2022, there was a large increase in new on-market listings. The supply of new offerings peaked in second quarter 2022, setting a record high with 283 new net lease drugstore listings. During this time, total closings, which represent overall demand, remained relatively stable with an average of 86 closings per quarter in 2022. This is just slightly lower than the five-year average of 90.1 closings per quarter, which created an environment with an increasing supply/demand imbalance and began contributing to the increasing cap rates mentioned above.

Net Lease Drugstores Sold Vs. New Listings

Since 2022, new on-market listings for net lease drugstores have decreased significantly causing supply to shift back down. In first quarter 2023, the number of new on-market listings totaled 149, which is a 44 percent decrease year-over-year, a 47 percent decline from the recent peak, and a 22 percent decrease from the five-year quarterly average of 191 listings. During this same period, the demand for retail pharmacies has begun to decrease, falling below the five-year average, and there has been an average 17.5 percent decrease over the past three quarters.

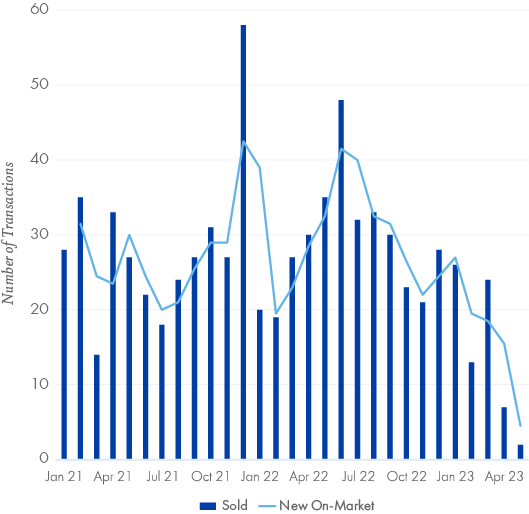

Net Lease Drugstores Monthly Sales Volume

This large decrease in deal volume is becoming more pronounced and is indicative of a downward shift in net lease pharmacy demand. Just one month into second quarter 2023, there were a total of seven net lease drugstore closings in April, which is an 87 percent decrease year-over-year and 76 percent lower than the average monthly sales volume over the last five years (28.8 closings per month). Unless trade volume increases significantly in the last half of the reporting period, second quarter 2023 will represent a massive decline in investment sales volume, which would indicate a significant slowdown in CRE sales for summer 2023.

This large decrease in deal volume is becoming more pronounced and is indicative of a downward shift in net lease pharmacy demand. Just one month into second quarter 2023, there were a total of seven net lease drugstore closings in April, which is an 87 percent decrease year-over-year and 76 percent lower than the average monthly sales volume over the last five years (28.8 closings per month). Unless trade volume increases significantly in the last half of the reporting period, second quarter 2023 will represent a massive decline in investment sales volume, which would indicate a significant slowdown in CRE sales for summer 2023.

Conclusion

There are notable trends in the net lease drugstore data that tell a story about the broader CRE market. First, like other CRE assets, cap rates have risen over the past year and will likely continue to rise through the end of 2023. However, there has been a flight to safety in assets with good real estate fundamentals, and cap rates for these assets have largely been able to weather shifting market conditions. This indicates that there is still capital to be spent, and demand for CRE remains – it is just focused on high quality assets.

Secondly, there was a large supply/demand imbalance in 2022 with a record number of new listings coming to market during a period of relatively stable demand. This began increasing cap rates for net lease drugstores with a six- to nine-month delay. Over the last nine months, cap rates have continued to increase while both supply and demand have decreased considerably.

With all else equal, these trends indicate a slow summer for CRE in 2023 with rising cap rates and low deal volume. However, this dual decrease in supply and demand may keep prices from falling too much, and we may trend toward a new equilibrium. Upcoming data from second and third quarters will likely give the best indication of the strength of market trends and where things will settle.

With today’s combination of high interest rates and high inflation, the net lease pharmacy segment may be the most important CRE indicator to follow. By closely tracking this segment, we can learn much about the broader market and identify trends early on. Using Northmarq’s internal sales comparable database, we are keeping a close eye on the net lease drugstore segment and are using this information to advise our clients on the best ways to navigate the market and capitalize on any changing dynamics.

Insights

Research to help you make knowledgeable investment decisions